开云手机入口于2013年10月18日挂牌成立,是省政府出资的国有独资企业。2021年,完成公司制改革,并划归省国资委监管体系。

作为全省交通强省建设的主力军和排头兵,河北交投集团业务涵盖交通基础设施领域的投资、建设、经营管理以及交通基础设施配套资源的综合开发,物流及相关配套服务,金融业务(融资租赁服务、商业保理服务;参股持牌类金融机构)以及城乡基础设施建设.....

Company Profile

Leading Members

Organization O

Enterprise Culture

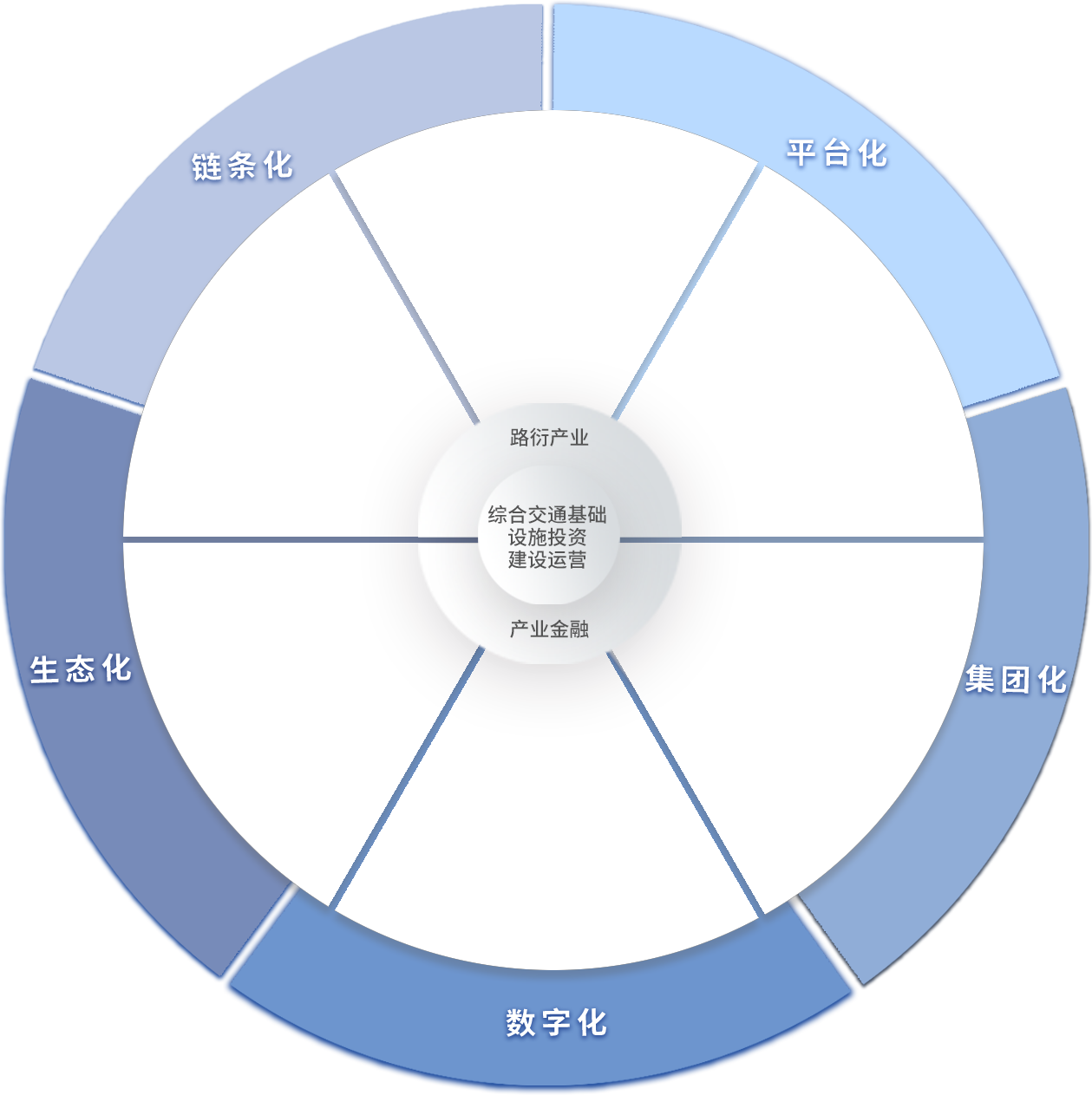

2021年,河北交投集团开启了“十四五”的新征程。到“十四五”末,力争打造成为具有国内影响力的综合交通运输投资运营集团,成为谱写交通强国河北篇章,建设经济强省、美丽河北的重要力量。

集团提出“三六五”战略,即“一体两翼六驱五化”。

大基建

囊括公路、港口、市政、轨道

交通、房地产开发、生态环保等工

程施工“全牌照”,打通基

础设施投资建设、运营

管理、养护维护“

全条链”。

大物流

发展多式联运,构建无缝隙、无间隔、便捷高效、大容量、低成本的“海陆空一体化”综合性智慧物流体系。

新金融

做与实业结合的金融,实现产融互动、以融拓径。通过产业基金、风险基金、投资基金等,集

聚社会投资,发展战

略新兴产业,打开高科技产业发展新通道。

新科技

发展绿色建材、智能交通、大数据、新基建、新能源、高端装备制造等交通新科技,打造科技产业新高地。

新能源

利用闲置的路域资源及对价补偿资源发展风能、光伏发电、氢能及储能产业,打造“风光氢储一体化”清洁能源产业体系。

大交通

推动全省高速公路运营管理“一张网”,担纲绘好综合交通基础设施投资运营“一张图”。